With Bonds All Things Are Equal

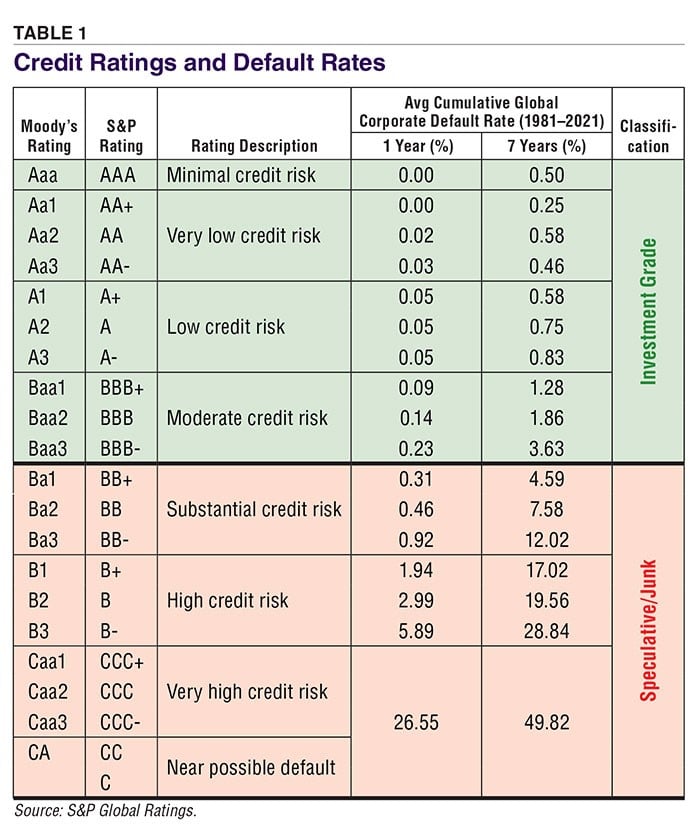

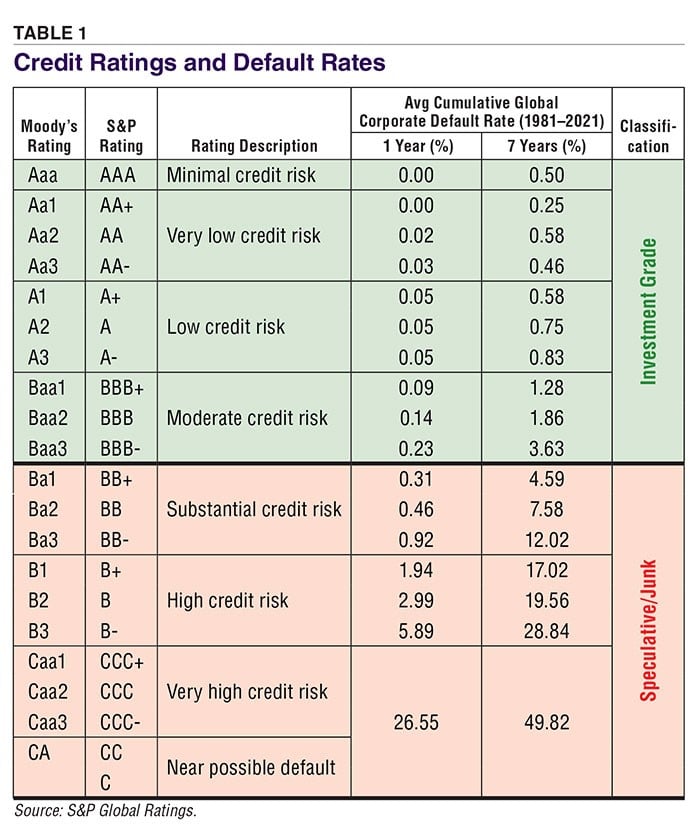

Today's Chart of the Day comes from an article in AAII.com (American Association of Individual Investors) and shows the average cumulative global corporate default rate from 1981-2021 in seven year spans.

A common misconception is that the yield you see from a bond portfolio is what you can expect to earn. However, this is a best case scenario as some of the bonds will ultimately default, causing a loss that reduces the yield.

In rough figures, if you take the weighted average default rate of all speculative/junk bonds and assume a 50% loss of principal of those bonds, over seven years this can reduce your total return by 2.9% annually.

The current yield to maturity on speculative/junk bonds is 7.6%. When you add in the historical loss of 2.9%, this reduces the total return to 4.7%, which happens to be the same yield of 4.7% in an investment grade bond with a similar maturity.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.