Seminars

Learn from the experts.

We’re proud to conduct free educational seminars led by our experienced Wealth Strategists.

Our seminars cover a wide array of topics about advanced planning and trust management. Learn how you can achieve your financial goals for yourself and your loved ones.

Upcoming Seminars

Will and Trusts: Creation and Funding

Learn the difference between a last will and testament and a revocable living trust, how each works, and how best to title assets and assign proper beneficiaries. Bring your questions and concerns related to your estate.

Presented by Kerry Hunter

April 16 | 10 a.m. | Englewood Chamber of Commerce Seminar Full. Please choose a different session.

May 7 | 10 a.m. | Crews Bank & Trust Venice

May 21 | 10 a.m. | Englewood Chamber of Commerce

The Benefits of Florida Residency

Moving to a new state brings many questions, including: Will my estate plan documents work in Florida, despite not being created here? Should I make Florida my homestead or domiciliary? Join us to review the challenges with out-of-state documents and the benefits of becoming a Floridian.

Presented by Kerry Hunter.

May 9 | 10 a.m. | Crews Bank & Trust Venice

May 17 | 10 a.m. | Englewood Chamber of Commerce

Bond Risk and How to Avoid It

Are your “safe” assets actually the riskiest? Did they lose value more than expected when the market pulled back? Avoiding high yield (junk) bonds, Step-up notes, indexed annuities, and leveraged assets can allow your portfolio to hold its value in bull and bear markets. Learn how portfolio managers analyze and screen fixed income assets. If you have mutual funds, exchange traded funds or individual bonds, this presentation will help in many ways.

May 8 | 10 a.m. | Crews Bank & Trust Venice

Estate Planning Mistakes

"Oops" is not a word someone wants associated with their estate plans. This seminar will discuss the basics of estate planning, including last will and testament and power of attorney, and offer examples of real-life mistakes we can learn from and apply to our personal plans.

May 22 | 10 a.m. | Englewood Chamber of Commerce

Schedule a free appointment to review your estate planning documents.

Schedule a free, 30-minute one-on-one appointment to review your trust, will, power-of-attorney, and healthcare directives. We will help you answer these questions:- Are your will, trust, durable power of attorney, and health care documents up to date?

- Does your living will and designation of healthcare surrogate accurately reflect your wishes?

- Is your will or trust fully funded to avoid probate?

- Will your estate plans from your home state function properly in Florida?

- Are your assets properly titled and appropriate beneficiaries designated?

Blog

On Our Minds

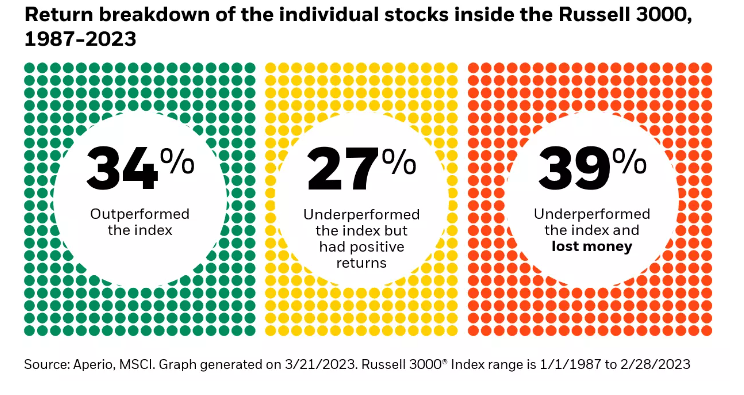

Chart of the Day: One Third

April 23, 2024

Today’s Chart of the Day from Aperio shows the percentage of individual stocks in the Russell 3000, which represents the 3,000 largest stocks in the...

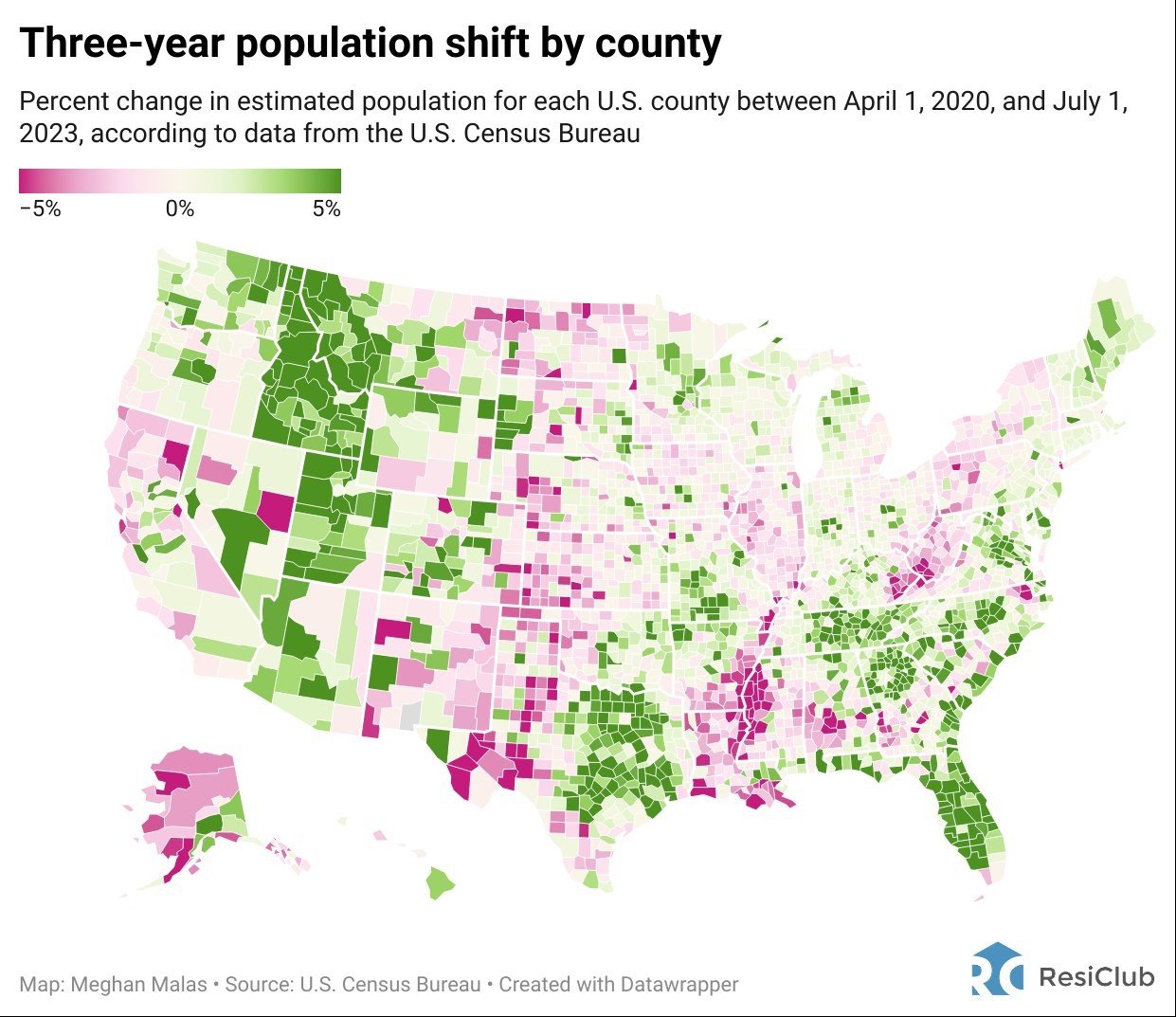

Chart of the Day: Population Shift

April 18, 2024

Today’s Chart of the Day is from Meghan Malas with data from the US Census Bureau.